The Moderating Effect of Type of Bank in Customer Retention for Islamic Banking in UAE

Written by Gleffany Pispis, Master of Global Business (MGB) student. SP Jain School of Global Management – Class of 2015.

The growing popularity of Islamic banking stems from two primary reasons: the desire to offer services to a growing Muslim population and the wish to tap the growing pool of international investors attracted to Sharia-compliant products (Sole, 2007). UAE’s Islamic finance sector has continued to outpace conventional banking growth. According to a news report from ratings agency Fitch, Islamic banks have successfully managed to reduce exposure to the real estate market. From the six largest Fitch-rated Islamic banks, total assets are at 20% of the industry in 1H2015 while total bank gross loans are at 21% in the same period. In 2015, the Central Bank approved to include Sharia-compliant securities accepted as collaterals.

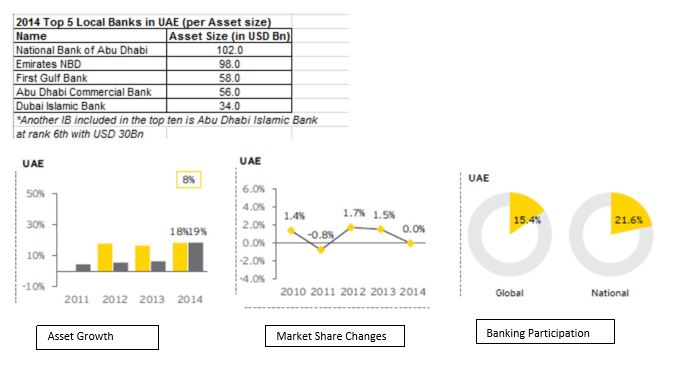

From 2010-2014, the Gulf Cooperation Council (GCC) has accelerated its growth with 18% YoY driving the overall CAGR to 16.19%. The industry is expected to reach 100 million customers and potential captive market stands six time bigger requiring Islamic financial institutions to adopt digital-first business banking model (EY Report, 2016). The positive industry projections coupled with a sizeable potential market creates a higher propensity for both full-fledged Islamic banks and conventional banks with Islamic windows to compete.

Islamic banks in UAE include: Abu Dhabi Islamic Bank, Al Hilal Bank, Ajman Bank, Dubai Bank, Dubai Islamic Bank, Emirates Islamic, Noor Bank, and Sharjah Islamic Bank. The growth in Islamic banking appears to be converging to traditional banks demanding fresh perspectives and more disruptive innovation from full-fledged Islamic banks. This poses a great area of concern for a geographic region that exhibits both business and religiosity.

UAE Banking in general has been in a steady, sound, and robust position thanks to prudent policies and supportive regulation from the UAE Central Bank and the government. As of June 2015, it has 23 local and 26 foreign banks with 957 branches spread across the seven emirates (National Bank of Abu Dhabi UAE Banking Sector Overview, 2015). Total banking sector assets reached a 7% YoY growth at USD 61B by 1H2015 and total net outstanding loans, net of provision stood at a 10% YoY increase at USD 361B by 1H2015.

UAE’s Islamic finance sector has continued to outpace conventional banking growth. According to a news report from ratings agency Fitch, Islamic banks have successfully managed to reduce exposure to the real estate market. From the six largest Fitch-rated Islamic banks, total assets are at 20% of the industry in 1H2015 while total bank gross loans are at 21% in the same period. In 2015, the Central Bank approved to include Sharia-compliant securities accepted as collaterals.

The growing popularity of Islamic banking has motivated the researcher to gain a deeper understanding on how UAE banks are marketing their services and how its customers from a myriad of backgrounds perceive these services. The study compared customer retention between full-fledged Islamic banks and conventional banks with Islamic windows in the areas of Islamic Reputation, Image, Service Quality, and Satisfaction.

The study compared customer retention between full-fledged Islamic banks and conventional banks with Islamic windows in the areas of Islamic Reputation, Image, Service Quality, and Satisfaction. The primary objective of this study is to identify the moderating effect of the type of Islamic banking (Full-fledged Islamic banks or Conventional banks with Islamic windows) in the relationship between identified factors and customer retention in UAE.

The findings of this study will be beneficial to bank management in formulating more effective marketing strategies in customer loyalty. Retention programs will be less expensive if banks would know where to focus their investments and expect returns. Results of this study will also educate bank clients and reaffirm their standards on choosing their long-term financial partners. Lastly, government and regulatory bodies will be facilitated in their policies and mandates regarding penetration of Islamic banking in the country.

Findings of the research revealed that all factors (Islamic Reputation, Bank Image, Service Quality, and Customer Satisfaction) directly affect customer retention in the United Arab Emirates. The relationship however is moderated in two of these factors, namely Bank Image and Customer Satisfaction.

Loyalty through bank image is, on the other hand, enhanced by the type of bank. In this regard, full-fledged banks lag competition as they have limited products and product extensions offered to clients. The banks should start working on conceptualizing how a certain offering can be authorized by Sharia, how these new products are marketed in full-compliant with Sharia, and how rates and profitability are enhanced in the eyes of the customers.

Customer satisfaction is another factor moderated by the type of bank in influencing customer retention for Islamic banks in the UAE. Conventional banks are generally more technologically-advanced and have more established standard operating procedures in customer relationship handling.

Recommendations of the study centered on two main themes:

1. Expanding the product lines into a wider variety of modern, more competitive offerings which are compliant with Islamic jurisprudence and Sharia; and

2. Leveraging on the use of technology to create online and mobile services that enhances customer relationships outside banking hours

About the Author: Gleffany Pispis

Gleffany is a Certified Public Accountant from the Philippines and has had an extensive  background in Risk Management as a Credit Risk Officer as well as in FMCG as a Trade Marketing analyst.

background in Risk Management as a Credit Risk Officer as well as in FMCG as a Trade Marketing analyst.

Gleffany is a member of the World Youth Alliance under UN and has expertise in contemporary marketing management during which she has published a ground breaking paper on Pharmaceutical marketing which got published in the American Journal of Medicine and the British Journal of medicine making her a well accomplished research scholar. In her free time, Gleffany likes to volunteer in social and entertainment events, travel, visit art galleries and museums and also make film critiques. She hates La la Land.

You can get in touch with Gleffany at:

Email – gnpispis@gmail.com

Linkedin – linkedin.com/in/gleffanypispis/

Facebook – facebook.com/doyougetwhatimean